Are you even looking for the right loan for your manufacturing business, but not sure which option actually fits your needs?

You are the one alone in this. Running a manufacturing unit involves a lot more than just production. It involves managing the cash flow, upgrading machines, handling bulk orders, and planning for long-term growth. Even the profitable manufacturers sometimes reach out to a point where the internal funds received do not turn out to be enough.

That is the reason why loans for manufacturers are becoming important. From working capital and machinery loans to government-backed funding schemes, there are multiple options available, but most manufacturers are not aware of what each one is meant for.

This blog explains it in simple terms. You will be able to find the main types of business loans available for manufacturers and the key government schemes that support manufacturing growth. No complicated finance language. Just clear information that helps you understand your funding options.

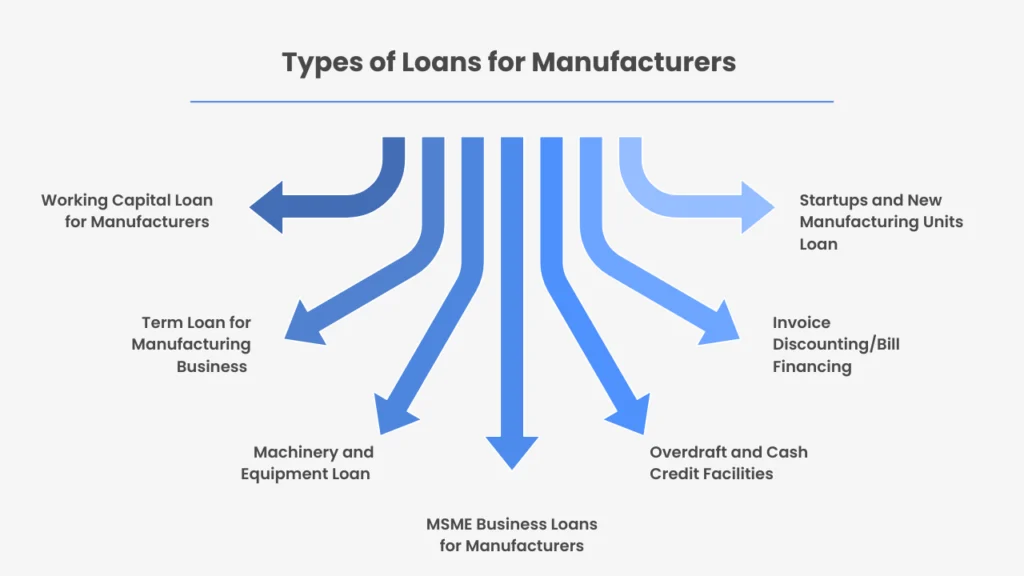

Types of Loans for Manufacturers

Not every manufacturer needs the same kind of funding. The right loan depends on what your business needs capital for. Daily operations, new machines, expansion, or delayed payments.

Here are the most common loan types used by manufacturers.

Working Capital Loan for Manufacturers

This loan helps you run your business every day. Manufacturing costs never stop. Raw materials, salaries, power, and transport all keep adding up. But customer payments often come late, which creates a cash gap.

A working capital loan fills that gap. It keeps the production moving and allows you to take new orders without stress.

Best for:

Daily expenses, bulk purchases, and large orders.

Term Loan for Manufacturing Business

This is a long-term loan. Manufacturers use it for planned growth and not for daily spending. It can be used to expand the factory, add a new production line or build a new infrastructure.

You are required to repay this over a fixed time, and usually in monthly instalments.

Best for:

Expansion, capacity increase, and long-term investment.

Machinery and Equipment Loan

This loan is used for buying machines. The entire manufacturing process is dependent on equipment. Better machines result in better output. Faster work, fewer errors, and more capacity.

Machinery loans help you to upgrade without paying everything at once. As a manufacturer, you can invest in CNC machines, packaging systems, and automation tools.

Best for:

New machines, technology upgrades, and better productivity.

MSME Business Loans for Manufacturers

These are loans for small and medium manufacturers. They are often linked to government support. Interest rates are usually lower, and access is easier for growing businesses.

Many manufacturers use MSME loans to scale operations without heavy financial pressure.

Best for:

Small units, growing manufacturers and affordable funding.

Overdraft and Cash Credit Facilities

This is flexible funding. You get a credit limit, and you use that money only when needed. Also, you are only required to pay the interest on the amount you use.

There is no fixed loan amount. This loan works like a financial buffer. It helps when the cash flow is uneven or when expenses rise suddenly.

Best for:

Irregular cash flow, short-term needs, and emergency expenses

Invoice Discounting/Bill Financing

The majority of the manufacturing system works on credit. Buyers take 30,60, or even 90 days to pay. But the costs continue every day, and the production cannot wait.

Invoice discounting gives you money against unpaid bills. You get funds now, instead of waiting for customer payments.

Best for:

Delayed payments, long-credit cycles, and B2B supply chains.

Startups and New Manufacturing Units Loan

These loans are there to support new manufacturers. They help out during the early stage, when setup costs are high, and revenue is still growing.

This can be used for buying a machine, factory spaces, or for basic operations.

Best for:

First-time manufacturers. New production unit.

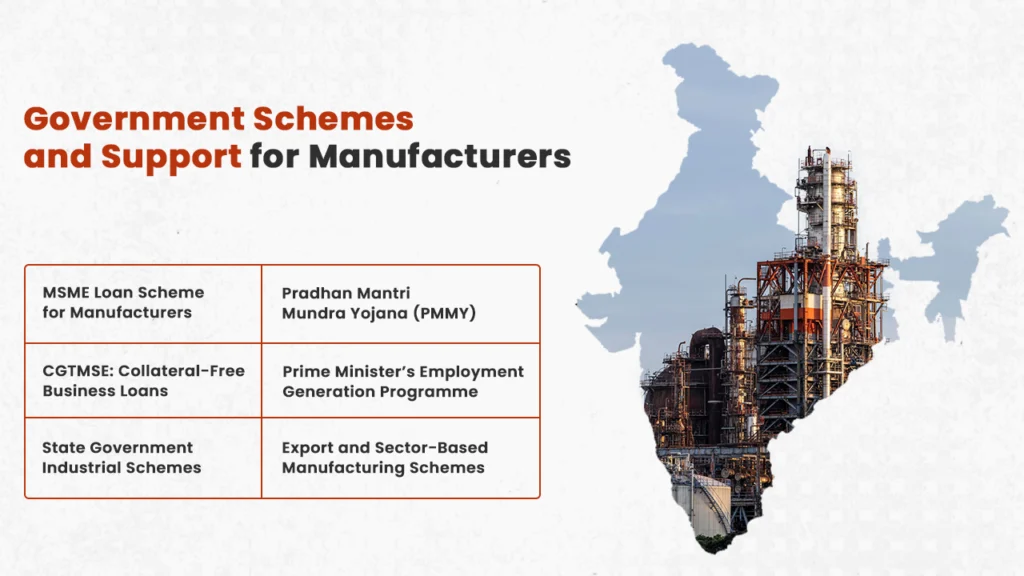

Government Schemes and Support for Manufacturers

The government offers several schemes that help manufacturing businesses grow. These schemes reduce risk, lower the cost of borrowing, and make funding easier for small and medium units.

Here are the most important ones that only manufacturers should know.

MSME Loan Scheme for Manufacturers

Most of the manufacturing units fall under MSME. There is no single fixed loan amount under “MSME loans”. Different banks and MBFCs offer MSME business loans.

In practice, manufacturers can get funding of ₹50,000 for small needs to ₹50 crore or more, depending upon

- Turnover

- Credit profile

- Collateral

- Bank policy

These are the loans that are used for machines, expansion, and daily operations.

Best for:

Small and mid-size manufacturers. Growing units.

Pradhan Mantri Mundra Yojana (PMMY)

Mundra Yojana is a government loan scheme for micro and small businesses. It provides collateral-free loans. The scheme is divided into three categories:

Shishu

This included loans up to ₹50,000 for very small or new units.

Kishor

Loan from ₹50,001 to ₹5 lakh. For businesses that have started and need more capital.

Tarun

This includes amounts from ₹5 lakh to ₹10 lakh for growing units ready to scale.

The maximum Mundra loan that can be offered goes up to ₹10 lakh.

Mundra is best for small manufacturing setups, workshops, home-based units, and tool-based production.

Best for:

Micro manufacturers. First-time entrepreneurs. Very small factories.

CGTMSE: Collateral-Free Business Loans

CGTMSE provides collateral-free loans to micro and small manufacturers. Under this, the government gives a credit guarantee to the lender so banks can lend without property or asset security.

Under CGTMSE:

- The maximum loan covered is up to ₹5 crore

- No collateral required for the guaranteed portion

This is one of the most important schemes for small manufacturing units.

Best for:

Small manufacturers. New businesses. Units without assets.

PMEGP: Prime Minister’s Employment Generation Programme

PMEGP supports new manufacturing units.

Under PMEGP:

- Maximum project cost for manufacturing: ₹50 lakh

- Government Subsidy: 15% to 35% of the project cost. (This can depend on category and location)

This subsidy helps in directly reducing the load burden. This makes starting a manufacturing unit easier.

Best for:

First-time manufacturers. Small factories. Rural and semi-urban units.

State Government Industrial Schemes

Each state in India runs its own industrial support programs. There is no single national limit here.

But most of the schemes offer:

- Loans from ₹10 lakh to ₹5 crore

- Capital subsidy for plant and machinery

- Interest subsidy on business loans

- Power tariff and land cost support

But the exact benefits of all of this depend on your state, manufacturing sector, and the location of your unit.

Best for:

Manufacturers are setting up new units. Expansion in industrial zones.

Export and Sector-Based Manufacturing Schemes

Some of the schemes support export-oriented manufacturers. Others focus on sectors like electronics, textiles, pharma, or auto parts.

Examples of this include:

- Production-linked Incentive (PLI) schemes

- Export promotion programs

- Technology upgradation incentives

There are no direct business loans. They provide:

- Performance-based incentives

- Cost reimbursement

- Tax and duty benefits

Financial support here can range from a few lakhs to several crores, depending on the scheme and production scale.

Best for:

Export manufacturers. Sector-specific production units.

A Helpful Tip for Lower Interest

In many government and bank loan schemes, women entrepreneurs get better terms. If your manufacturing business can be registered in your mother’s name or any female member, you may get:

- Lower interest rates

- Higher subsidy in some schemes

- Higher subsidy in some schemes

- Easier loan approval in certain programs

This applies to schemes like Mudra, PMEGP, and some state government loans.

It does not mean every loan will be cheaper. But in many cases, women-led businesses receive priority benefits.

So, before applying, it is worth checking: Can this business be registered in a woman’s name? If yes, it may reduce your overall loan cost.

How B2BOneMart Can Help Manufacturers After They Receive Funding

A loan helps you produce more. But production alone is not growth. To grow, you need more buyers, visibility, and the right business connections.

That is where B2BOneMart helps.

B2BOneMart is built only for manufacturers. It is a platform that connects you with serious B2B buyers. Your increased capacity needs demand, your new machines need orders, and expansion needs the right market.

To strengthen growth further, manufacturers should also focus on digital visibility and outreach.

Resources like marketing guide for manufacturers and seo for manufacturers can help you attract the right buyers consistently.

Funding builds your ability to produce, and B2BOneMart helps you turn that production into business.

Manufacturing Business Loans: FAQs You Should Know

1) What is the best loan for a manufacturing business?

There is no single best loan. It depends on your needs. Working capital is for daily expenses. Machinery loans are for equipment. Government schemes work well for small units.

2) How much loan can a manufacturer get in India?

It depends on your business size. Small units may get a few lakhs. Growing manufacturers can get several crores. The amount depends on turnover, credit, and the scheme.

3) Are government loans cheaper than private business loans?

In many cases, yes. Government schemes often have lower interest rates or subsidies. But they may have limits and conditions.

4) Is collateral required for manufacturing business loans?

Not always. Mudra and CGTMSE offer collateral-free options. Larger loans may still require security.

5) What is the maximum loan under Mudra Yojana?

The maximum loan is ₹10 lakh. It is divided into Shishu, Kishor, and Tarun categories.

6) Can women entrepreneurs get lower interest rates on business loans?

In many schemes, yes. Women-led businesses often get better terms. This may include lower interest or higher subsidy.

7) Are government schemes available for large manufacturing units?

Most schemes focus on small and medium businesses. Large units usually rely on regular business loans or sector-specific incentives.

8) How do I know if my unit comes under MSME?

If your investment and turnover are within MSME limits, you qualify. Most small and mid-size manufacturers fall under MSME.

9) Is it better to take one large loan or multiple small loans?

One well-planned loan is usually better. Multiple loans increase pressure. And make repayment harder.

10) Do government schemes take longer than regular bank loans?

Sometimes, yes. Government schemes involve verification. But they often reduce your cost in the long run.

11) Can I apply for more than one government scheme?

In some cases, yes. But you cannot take double benefit for the same purpose. Each scheme has its own rules.

12) What if I do not have property or assets for security?

You still have options. Mudra and CGTMSE do not require collateral. They are designed for businesses without assets.